Direct Compensation Property Damage Auto Insurance in Alberta

Effective January 1, 2022, Alberta is changing the way vehicle damage claims are handled after accidents. Going forward, your insurance policy will include mandatory Direct Compensation Property Damage (DCPD) coverage. The aim is to make insurance claims simpler and faster for you. Over the long term, this will simplify the claims system and potentially lower costs.

DCPD coverage applies to damage to your vehicle and contents in or on your vehicle (some restrictions apply for commercial vehicles). It also applies to your loss of use coverage (alternative transportation when your vehicle is not drivable after being damaged in an accident).

Below, we’ll answer some of the more pressing questions about DCPD coverage.

What is Direct Compensation Property Damage (DCPD) Insurance?

DCPD means your own insurance company will pay for the repairs of your vehicle if you’re involved in an accident where another driver is at fault or partially at fault. Previously, the other driver’s insurer would pay for physical damage in this scenario. DCPD should improve your claims experience by making it quicker and easier to get your vehicle repaired.

However, it does not change your overall coverage, only who pays for the damage. DCPD only applies when you’re not at fault or only partially at fault in a collision.

How does DCPD insurance work?

If you’re involved in an accident, you’ll submit your claim to your own insurance company:

- If you’re not at fault for the collision: Your DCPD coverage will cover all repairs to your vehicle.

- If you’re partially at fault: Your DCPD coverage will cover a percentage of the repairs to your vehicle.

- If you’re at fault: You don’t have coverage under DCPD – you’ll need collision or all-perils protection to have repairs for your vehicle covered.

Here are some claims examples of how DCPD insurance will work in Alberta:

You’re driving a vehicle worth $18,000 on the market if you decided to sell it today (known as actual cash value in insurance lingo). Unfortunately, you’re involved in an accident and your vehicle has some damage which will cost about $5000 to fix.

If you’re not at fault for the accident, you’d submit your claim to your insurer and your DCPD coverage would respond. With a $0 deductible, the entire $5000 would be covered.

If you’re partially at fault, you’d submit your claim to your insurer and your DCPD coverage will partially respond. It’s determined you’re 25% at fault for the accident. Your DCPD coverage will cover 75% of the damage. With a $0 deductible, this would be $3750. You’d need to pay the remainder out of your own pocket unless you had collision or all-perils coverage.

If you’re partially at fault and your deductible is over $0, you will only pay a portion of that deductible. In this case, if your deductible was $500, you’d pay $375 because you were 25% responsible for the accident.

If you’re at fault, your DCPD insurance does not cover you. If you have collision or all-perils coverage, the repairs would be covered under that section of your insurance. If you do not have this protection, you’ll need to pay for the repairs out of your own pocket.

What vehicles and insurance policies are affected?

DCPD coverage will be mandatory on personal vehicles, commercial vehicles and fleets, motorhomes, motorcycles and ATVs.

Essentially, if you own a vehicle and have an insurance policy in Alberta, this applies to you!

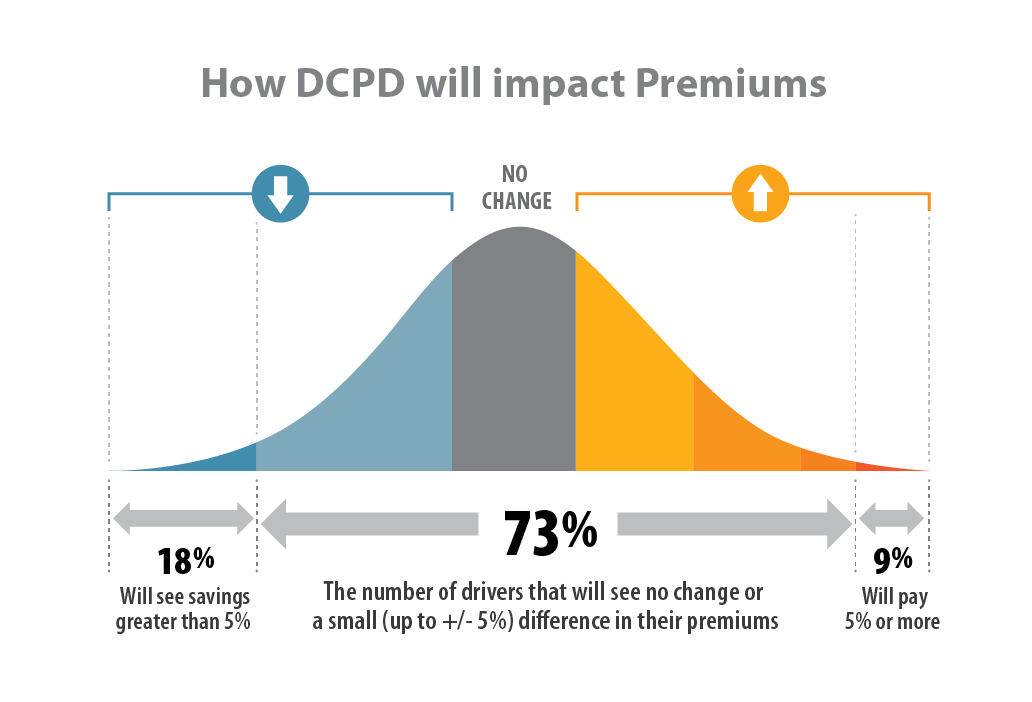

Will my insurance rates go up because of DCPD insurance?

You may see a change in your insurance premiums. Owners of vehicles that are less expensive to repair will pay less for their insurance whereas owners of vehicles that are more expensive to repair will pay higher premiums. This is a fairer system.

According to the Insurance Bureau of Canada, 42% of drivers will see a decrease in their rates; 15% will see no change; 34% of drivers will see an increase between 0% and 5%.

This coverage is automatically included at a $0 deductible; however, you may be able to raise this in order to get lower premiums overall.

DCPD will reduce claim costs and help stabilize insurance premiums over the long term.

Why is Alberta moving to a DCPD system?

DCPD is already in place in Ontario, Newfoundland and Labrador, New Brunswick, Nova Scotia, Prince Edward Island and Quebec. BC, Saskatchewan and Manitoba also have similar systems. The Alberta Government is joining these other provinces.

The aim is to simplify and improve the claims system in Alberta.

What are the benefits of DCPD?

The benefits of DCPD are:

- Your claims process should be much easier and faster.

- Long-term, costs should be lowered and the claims system more efficient.

How is my auto insurance going to be affected?

Your insurance will include DCPD coverage effective January 1, 2022. DCPD does not change your overall coverage, just who pays for physical damage when you’re partially at fault or not at fault.

If you’re at fault for the damage, nothing changes. In this case, repairs to your vehicle are only covered if you have collision or all-perils coverage.

Keep in mind this affects all Alberta auto policies including personal vehicles, commercial vehicles, motorhomes, motorcycles and ATVs.

What will my deductible be for DCPD coverage?

Deductibles for DCPD coverage will default to $0. You may have the option to increase your deductible to lower your premiums overall.

(A deductible is the amount you pay out of pocket when you have a claim.)

Please contact us if you’d like to discuss your deductible options.

Who determines fault? What if I don’t know who’s at fault for the accident?

You won’t need to know who is at fault in the accident as the claims adjuster determines fault. Guidelines are set by the Insurance Act of Alberta and will be based on the information provided by those involved in the accident.

What happens if someone is injured in the accident?

DCPD only applies to physical damage to your vehicle. Injury claims are still covered under third party liability insurance.

What if the other driver doesn’t have insurance?

Unfortunately, if the other driver isn’t insured there is no coverage for physical damage to your vehicle unless you have Collision/All-Perils coverage.

If I’m in an accident where the other driver is at fault, is the stuff in my car covered?

Yes, DCPD will cover the contents of your vehicle are damaged in an accident as long as the other driver is at fault or partially at fault. If you’re at fault, you won’t have coverage under your auto insurance.

Do I need to do anything?

No, there is no action required from you.

My insurance renews later in 2022, when will I get the DCPD coverage?

Regardless of your renewal date, all auto insurance policies will have DCPD coverage as of January 1, 2022.

Want to know all about Auto insurance quotes? don’t miss our full guide for Auto insurance.

If you have any further questions or concerns, please contact your Rogers Insurance Professional to get a quote today.