2022 Insurance Market Forecast

The hard market challenges of the past few years will continue into 2022. But there is good news — things are starting to stabilize as insurers ease rate hikes for some coverages and industries and increase capacity to underwrite certain risks.

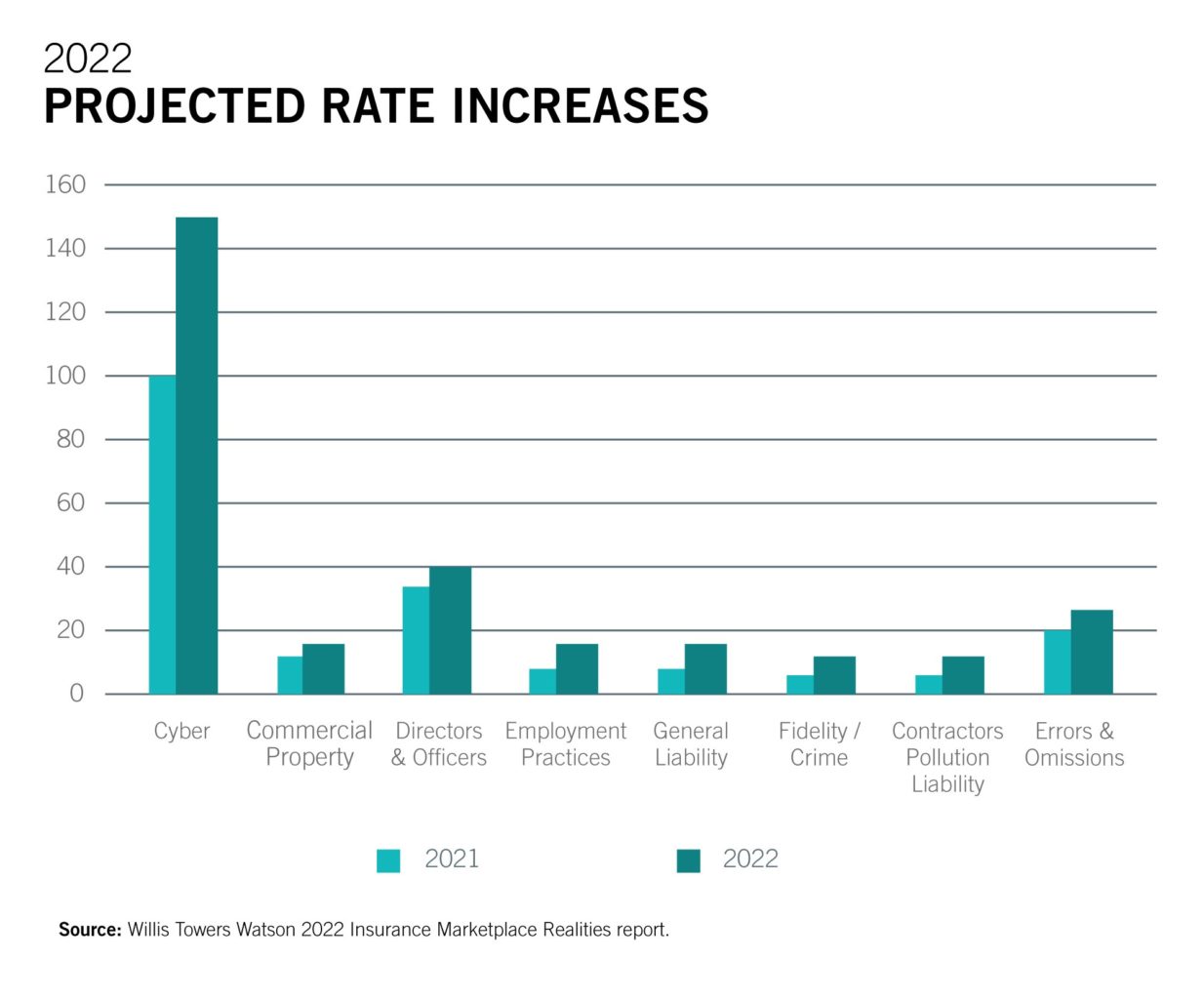

Businesses should still anticipate rate increases in 2022, depending on their sector. Some estimates state the average increase will be single digit; however, insurers are increasingly focusing on specific lines of liability coverage and double-digit hikes are expected for certain lines that have experienced high losses — cyber liability in particular.

“While the industry is performing better, insurers will increasingly be more selective in who they choose to insure,” says Lee Rogers, President, Rogers Insurance Group of Companies. “Underwriting scrutiny and a better understanding of risk management and loss control will continue.”

What’s Driving Rate Increases?

- Cybercriminals are consistently launching more aggressive attacks on companies of all sizes, resulting in steeper and more frequent claims.

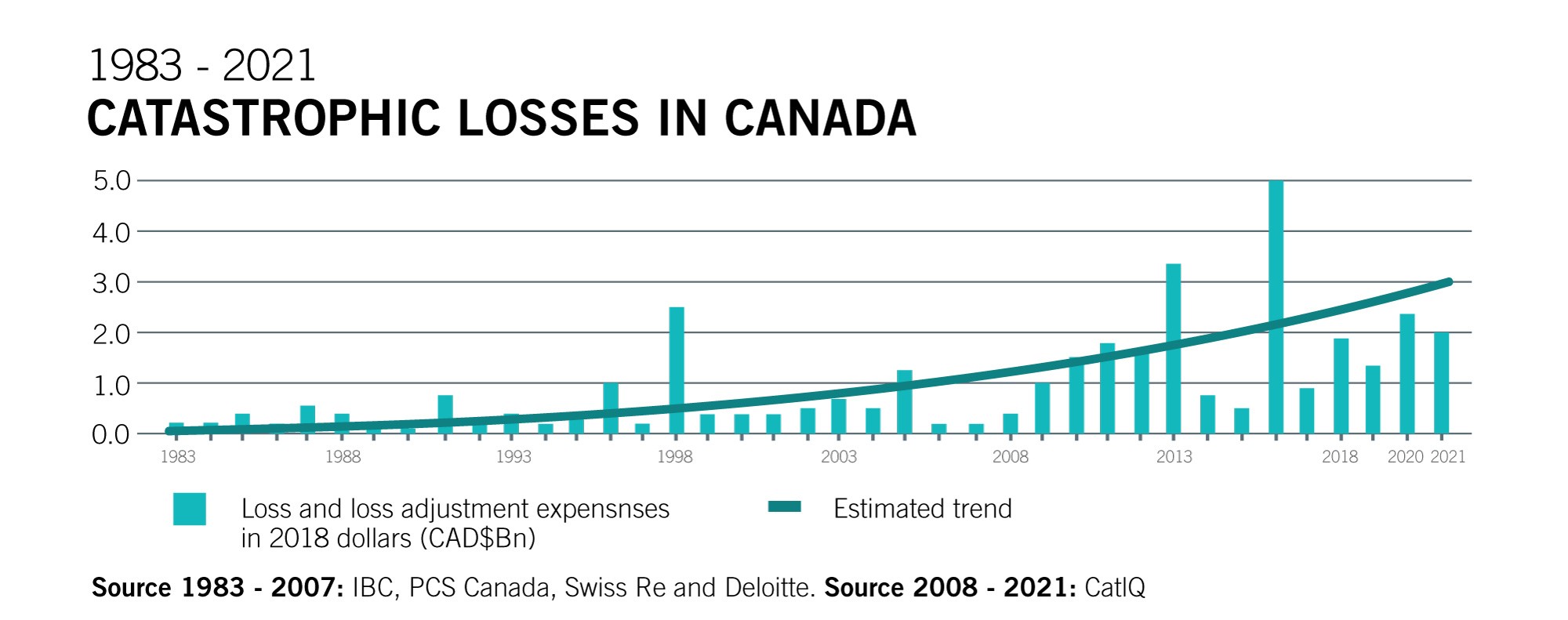

- Climate change is causing more severe and frequent catastrophic natural events, leading to higher losses.

- Repair and replacement costs have spiked due to several factors, including increased costs for raw materials; material and labour shortages; global supply chain issues; and inflation.

- Historically low interest rates are impacting insurers’ overall profitability.

- Catastrophic and attritional losses are increasing in severity and occurrence, which continues to strain the insurance industry.

Trends That Will Impact Your Insurance in 2022

COVID-19 has affected and, in many cases, amplified social, economic and financial challenges, which in turn impacts insurance (i.e., higher rates, evolving risk mitigation tactics that underwriters require). Here are four trends we anticipate will impact your insurance in 2022.

Cyber Threats

Cyber claims are drastically on the rise with hackers consistently launching more severe and sophisticated attacks. Couple this with the rapid transition to remote work in 2020, and businesses of all sizes are more susceptible to cyberattacks.

Furthermore, political tensions have caused some insurers to add exclusions related to state sponsored attacks to their cyber products. For example, Lloyd’s of London announced in November 2021 it will no longer cover losses that result from ‘cyber war,’ which is when one country launches a cyberattack against another.

Due to the high-level of cyber risk, underwriters are scrupulously examining an organization’s cyber hygiene practices.

What You Can Do:

- Strengthen your perimeter security. Close and replace all unnecessary remote desktop protocols with a secure VPN that is protected by multi-factor authentication.

- Strengthen your email security. Use multi-factor authentication and regularly educate your staff on how to spot and respond to attempted breaches (i.e., phishing attacks).

- Strengthen your data security. Regularly back up your company data on at least two different kinds of media — including one stored safely offsite. Also regularly test your backups to ensure your data is accessible and readable.

- Speak with your broker about your current cyber coverage and also about additional mitigation efforts that can help protect you from a cyberattack.

The average total cost to recover from a ransomware attack was

$1.85 million in 2021—more than double from the year before.

(Source: The State of Ransomware 2021)

Environmental, Social & Governance Policies

Insurers are increasingly scrutinizing companies’ environmental, social and governance (ESG) policies and performance. Issues such as pollution, diversity and inclusion, and corporate conduct have been receiving greater public attention, resulting in more litigation.

This has resulted in underwriters examining ESG to assess a company’s liability risk and potential exposures.

What You Can Do:

- Prioritize your company’s ESG policy, including enacting procedures and protocols for monitoring, tracking and reporting on progress.

- According to the Allianz Global Corporate & Specialty report released in October 2021, five ESG risks to be aware of are:

- Climate change and pollution: What is your company doing to reduce its carbon footprint?

- Board diversity: Does your board have diverse representation?

- Greenwashing: Is your company setting realistic environmental goals? Exaggerating your performance will backfire.

- CEO performance: Would your company consider measuring your leader’s performance to successful ESG outcomes?

- Cybersecurity: What is your company doing to reduce its risk of a cyberattack?

78% of insurers believe COVID-19

accelerated their focus on ESG.

(Source: BlackRock)

Global Supply Chain Issues

Challenges exasperated by the pandemic (i.e., product and staffing shortages) and climate change have exposed just how vulnerable the global supply chain is.

The strain this has put on businesses has highlighted the need to prioritize business continuity planning and diversification of materials and suppliers — things that insurers are looking for.

What You Can Do:

- Conduct a thorough risk assessment to identify ongoing and emerging local, regional, national and global disruptions that could affect your business operations.

- Review, enhance and test your business continuity plan. Outline how your business will respond to a disruption, including plans for staffing, inventory and storage, supplier backups, communication and more.

- Determine how you can diversify your organization’s supply chain — your suppliers, the products and materials you use, and how these items travel to you.

70% of Canadian supply chain organizations have experienced supply

chain disruptions as a direct result of COVID-19 implications.

(Source: Supply Chain Canada)

COVID-19

The focus on COVID-19 has shifted from how to conduct day-to-day business to how to keep employees safe, manage vaccine compliance and avoid lawsuits.

Litigation against employers as it relates to virus, however, is starting to increase in Canada. Cases are diverse, ranging from failure to provide a safe and healthy workplace, to wrongful termination, discrimination, vaccination policy disputes and more.

As a result, insurers are re-examining the level of risk they’re willing to assume, which is impacting the cost and ability to secure certain coverages — employment practices liability and directors and officers liability in particular.

What You Can Do:

- Follow all government and health authority requirements in each of the jurisdictions where your organization operates. Clearly communicate all measures that staff need to follow and document your compliance.

- Consult with a qualified lawyer on any return-to-work protocols or vaccine mandates; they can identify and advise on how to remedy any potential gaps that may leave you vulnerable to a liability claim.

- Implement reasonable measures to maintain the privacy of your employees, including any coronavirus-specific details you may collect (i.e., positive tests, vaccination records).

Lawyers anticipate a spike in employment practices lawsuits

related to COVID-19, ranging from privacy breaches to

failure to comply to public health guidelines.

(Source: Levitt Sheikh Employment Labour Law)

These trends underscore how crucial it is to prioritize extensive risk assessment and management. Contact us to discuss ways your business can mitigate risk.

Contact your Rogers Insurance Professional today.

Related reading: